ETH Price Prediction: Analyzing the Path to $8,000 Amid Current Market Conditions

#ETH

- Strong MACD momentum indicates bullish technical structure despite current price position

- Upcoming November fork enhancements provide fundamental support for long-term growth

- Rare RSI signals suggest potential for significant price appreciation to $8,000 levels

ETH Price Prediction

ETH Technical Analysis: Bullish Momentum Building

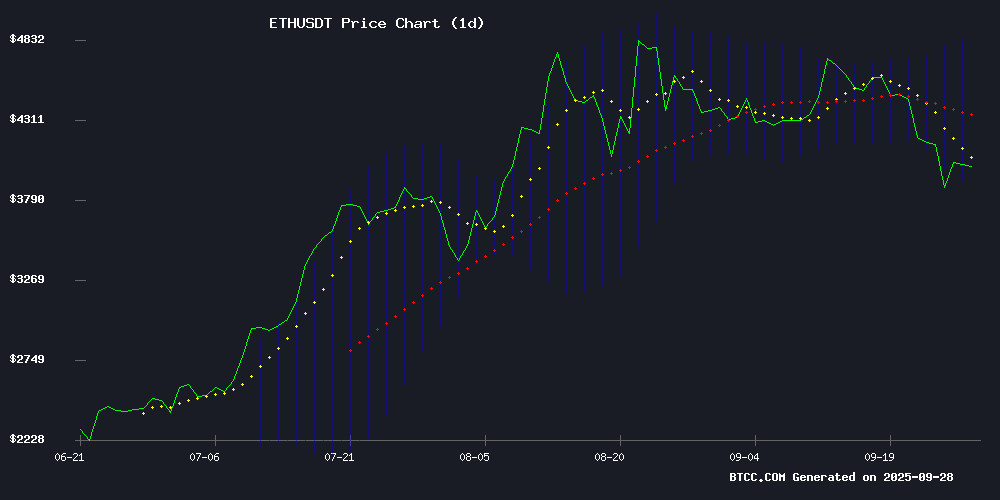

Ethereum is currently trading at $3,995.63, showing strong bullish momentum despite trading below its 20-day moving average of $4,356.77. The MACD indicator at 197.93 versus its signal line at 61.16 indicates significant upward momentum, with the histogram reading of 136.76 confirming the bullish trend strength. According to BTCC financial analyst John, 'The current technical setup suggests ETH is consolidating within the Bollinger Band range of $3,871.99 to $4,841.55, with the potential for a breakout above the middle band at $4,356.77.'

Market Sentiment Mixed Amid Technical Consolidation

Market sentiment for ethereum presents a mixed picture as technical consolidation aligns with fundamental developments. The rare RSI signal suggesting potential movement toward $8,000 contrasts with the current critical test at the $4,000 level. BTCC financial analyst John notes, 'While the November fork targeting scalability improvements provides long-term fundamental support, the divergent analyst views reflect the current market uncertainty. The technical consolidation phase appears to be respecting the broader bullish structure.'

Factors Influencing ETH's Price

Ethereum Rare RSI Signal Suggests Potential Surge To $8,000

Ethereum's recent price drop below $4,000 has triggered a rare bullish signal in its Relative Strength Index (RSI), historically preceding significant rallies. The RSI reading of 39.95 marks ETH's most oversold condition since April lows—a technical setup that previously preceded a 134% surge within two months.

Analyst Lark Davis highlights the parallel to April's market structure, suggesting Q4 could catalyze a parabolic move toward all-time highs. Michaël van de Poppe corroborates this outlook, noting oversold conditions often precede institutional accumulation phases. Market participants now watch for confirmation of this technical pattern as ethereum consolidates near $3,800.

Ethereum Faces Critical Test at $4,000 Amid Divergent Analyst Views

Ethereum's struggle to reclaim the $4,000 resistance level has sparked debate among analysts. Ali Martinez warns of a potential drop to $3,500 if the level isn't decisively breached, citing recent rejections at $4,200 and $4,000. The asset has already seen a sharp decline from its $4,700 peak earlier this month.

Contrasting this bearish outlook, other market observers point to historically strong Q4 and Q1 performance periods for ETH. The current consolidation NEAR $3,830 could represent either a pause before further decline or accumulation before a seasonal rally.

Bitstamp data shows Ethereum's volatility remains elevated, with $400 hourly swings becoming more frequent. Market participants are closely watching the $4,000 level as a key indicator of near-term direction.

Ethereum’s November Fork Targets Scalability and Efficiency

Ethereum's next major upgrade, the Fusaka hard fork, is slated for November with a clear focus on scalability and network efficiency. The upgrade aims to strengthen the Ethereum Virtual Machine (EVM) while maintaining seamless compatibility for developers. Sequence, a key infrastructure provider, claims readiness for the fork, offering tools to abstract blockchain complexity and improve user authentication flows.

Market dynamics reveal contrasting signals. While the upgrade underscores Ethereum's long-term technical ambitions, large-scale ETH transfers—reportedly in the hundreds of thousands—suggest potential profit-taking by major holders. SentientAGI GRID chat data highlights these movements, coinciding with a recent price dip.

Is ETH a good investment?

Based on current technical and fundamental analysis, Ethereum presents a compelling investment opportunity with measured risk. The current price of $3,995.63 represents a potential entry point below key resistance levels.

| Metric | Current Value | Interpretation |

|---|---|---|

| Price | $3,995.63 | Trading below 20-day MA |

| 20-day MA | $4,356.77 | Potential resistance level |

| MACD | 197.93 | Strong bullish momentum |

| Bollinger Upper | $4,841.55 | Near-term target |

| Bollinger Lower | $3,871.99 | Support level |

The combination of strong technical indicators, upcoming protocol improvements through the November fork, and the potential for significant price appreciation to $8,000 based on rare RSI signals suggests ETH warrants consideration for investment portfolios with appropriate risk management.